will child tax credit continue in 2022

But without intervention from Congress the program will instead revert back to its original form in 2022 which is less generous. It also raised the age limit for.

Credit Karma Tax Ux Case Study Ux Planet Credit Karma Case Study Tax Software

15 there is still more of that money coming to Americans in 2022.

. However if the Build Back Better act passes the Senate it would extend the. Child tax credit payments will continue to go out in 2022. This credit begins to phase down to 2000 per child once household income reaches 75000 for individuals 112500 for heads of household and 150000 for.

The good news is. Now even before those monthly child tax credit advances run out the final two payments come on Nov. However for 2022 the credit has reverted back to 2000 per child with no monthly payments.

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. The child tax credit isnt going away. Washington lawmakers may still revisit expanding the child tax credit.

Losing it could be dire for millions of children living at or below the poverty line. As of now the size of the credit will be cut in 2022 back to 2000 some families earned up to 3600 in 2021 with full payments only. The bill did not pass and advanced monthly Child Tax Credit payments will not continue in 2022 though parents can still claim a portion of the 2021 expanded credit on their tax returns this season.

Ad The new advance Child Tax Credit is based on your previously filed tax return. Child tax credit payments will continue to go out in 2022. Not only that it would have modified it to include the following.

Ad Free tax support and direct deposit. The benefit for the 2021 year is 3000 and 3600 for children under the age of 6. 03282022 0431 AM EDT.

Answer Simple Questions About Your Life And We Do The Rest. Therefore Child Tax Credit Payments Will Not Continue In 2022. Therefore child tax credit payments will NOT continue in 2022.

Close to 36 million families received half of the child tax credit up to 300 per month for those with. File With Confidence Today. Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17.

American parents have likely received their. The new child tax credit will go into effect for the 2021 taxes. Bonamici pushes for child tax payments to continue in 2022.

An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. The advance is 50 of your child tax credit with the rest claimed on next years return. However Congress had to vote to extend the payments past 2021.

Those payments however are set to end in December though if some lawmakers have the way the money will keep flowing in 2022. President Bidens 2 trillion Build Back Better social spending bill would have continued the the Child Tax Credit through 2022. 15 Democratic leaders in Congress are working to extend the benefit into 2022.

The law authorizing last years monthly payments clearly states that no payments can be made after December 31 2021. Jayapal pledged that progressives would continue to push for the. And while the final monthly payment of 2021 went out Dec.

An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. Here is what you need to know about the future of the child tax credit in 2022. Currently the expanded child tax credit provides 3600 for each.

No Tax Knowledge Needed. The Final Enhanced Child Tax Credit Payment Is Arriving With Tax Refunds This Year. Fri 18 Mar 2022 0800 EDT Last modified on.

As it stands right now payments will not continue into 2022. 2 days agoWhile the Child Tax Credit has dominated the debate in Washington the Child and Dependent Care Credit provides an even bigger benefit to some parents. Eligible families received the first half via monthly payments of up to 300 per child under 6 years of age and up to 250 per child between the ages of 6 and 17.

The future of the monthly child tax credit is not certain in 2022. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

KOIN Nearly 93000 families across the Pacific Northwest are getting their final expanded child tax credit payment. The monthly payments from the expanded child tax credit were not distributed. As it stands right now child tax credit payments wont be renewed this year.

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Looking To Buy Your First House This Ultimate Checklist For First Time Home Buyers Is The Blue First Time Home Buyers Buying Your First Home Buying First Home

The Chronicles Of Bonnie And Clyde Continue Well For Clyde In 2022 Bonnie N Clyde Clyde Alcatraz

Insights Into Editorial The Shape Of Growth Matters Insights Insight Growth Economy

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

How Long Do Solar Panels Normally Last In 2022 Solar Panel Companies Solar Installation Solar Energy Companies

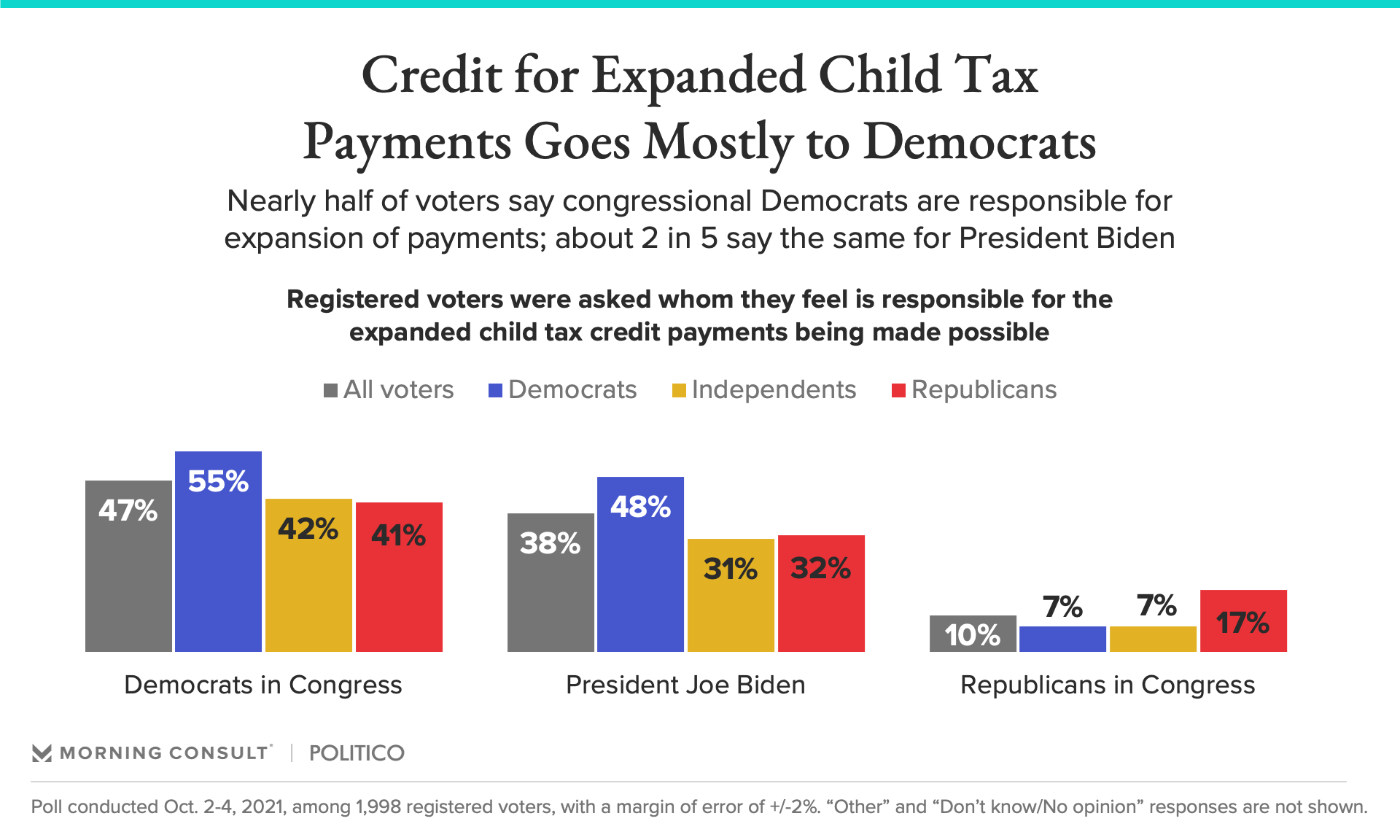

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

What You Need To Know About Your 2020 Taxes How You File In 2021 Income Tax Preparation New Year Wishes Filing Taxes

Trump S Wasteful Tax Cuts Lead To Continued Trillion Dollar Deficits In Expanding Economy

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

Here S What Has To Happen For Child Tax Credit Payments To Continue In 2022 Wjhl Tri Cities News Weather

Restaurants Seek Input Tax Credit Low Interest Loans From Budget 2022 In 2022 Budgeting Low Interest Loans Tax Credits

What To Know About The Child Tax Credit The New York Times

State Wire Tax Prep Help For Low To Moderate Income Ma Families In 2022 Child Tax Credit Tax Prep Empowerment Program

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

30 Cover Letter Example Resume Cover Letter Examples Cover Letter For Resume Writing A Cover Letter